Welcome to the ultimate guide for those aspiring to establish or advance their career in the insurance industry. The insurance sector is a backbone of financial stability for individuals, businesses, and communities, navigating through future uncertainties with precision and care. This guide is crafted to illuminate the path for job seekers, offering insights into the educational prerequisites, specialist areas, indispensable skills, and the diverse opportunities that make the insurance field both unique and rewarding.

Whether you are drawn to the industry by the prospect of helping people manage risks, a keen interest in financial products, or the allure of a stable and growing career path, this guide provides the information you need. The spectrum of opportunities is vast and varied, from entry-level insurance jobs to specialized roles such as commercial insurance jobs.

The demand for skilled, diverse, and dynamic professionals has never increased as the insurance industry evolves to address new challenges and harness technological advances. This guide invites you to explore the multifaceted world of insurance jobs, equipped with the knowledge and resources to take the next step in your career journey. Join us in delving into a sector where stability meets innovation and diversity is welcomed and celebrated.

Educational Requirements

Launching a career in insurance starts with a solid educational foundation. Most insurance jobs, including entry-level and insurance investigator jobs, require at least a bachelor’s degree. Business, finance, or related studies are the usual suspects. But the true game-changer comes with certifications.

To stand out, consider pursuing specific industry credentials like Chartered Property Casualty Underwriter (CPCU) or Certified Insurance Counselor (CIC). These are not just letters after your name; they demonstrate your commitment and expertise, which are the keys to climbing the ladder in the fast-paced world of insurance.

But learning doesn’t stop there. The insurance field is dynamic and influenced by changes in law, technology, and market conditions. Continuous learning is crucial. Whether taking online courses, attending workshops, or reading up on the latest industry trends, staying updated is your ticket to success. Embrace the journey of education; it’s your pathway to thriving in the insurance sector.

Areas of Expertise

The insurance field offers various specialties, each with its challenges and rewards. Here are a few areas where you can make your mark:

- Health Insurance: Focus on policies that provide medical expenses coverage. This area is especially relevant to the increasing healthcare needs.

- Life Insurance Agent Jobs: Help clients secure their family’s financial future by offering life insurance policies.

- Property and Casualty Insurance: In this domain, you’ll manage policies that protect against property losses or liability.

- Underwriting: Evaluate and analyze the risks of insuring people and assets. This role requires a keen eye for detail and strong decision-making skills.

- Claims Adjusting: Work on the front lines by assessing insurance claims. This role is crucial in determining the extent of the insurer’s liability.

- R.N. Insurance Jobs: Combine healthcare knowledge with insurance expertise. Nurses in this role assess claims involving medical procedures or health histories.

Each area requires a unique blend of skills and knowledge, catering to diverse interests and strengths. Whether assisting individuals with their health concerns, securing their financial futures, or assessing property and liability risks, the insurance field offers many opportunities to make a significant impact.

Demographics in the United States

The insurance sector, mirroring society’s evolving landscape, shows diversity in its workforce. Understanding the demographic makeup of insurance professionals in the U.S. sheds light on this progress and areas for growth.

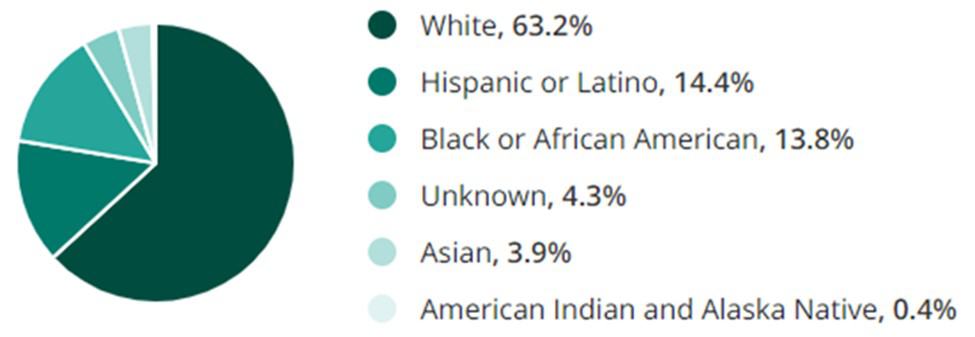

Ethnicity/Race:

- White: 63.2%

- Hispanic or Latino: 14.4%

- Black or African American: 13.8%

- Asian: 3.9%

- Other: 4.7%

The field has a significant presence of White and Hispanic or Latino individuals, displaying ongoing efforts to enhance diversity within the industry.

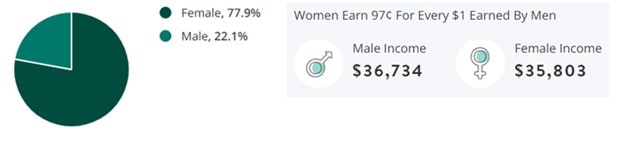

Gender:

The insurance industry shows a promising trend toward balancing gender representation:

- Female: 58%

- Male: 42%

This trend indicates a strong female presence in insurance jobs, contrasting with many sectors within finance and highlighting the industry’s support for women’s professional growth.

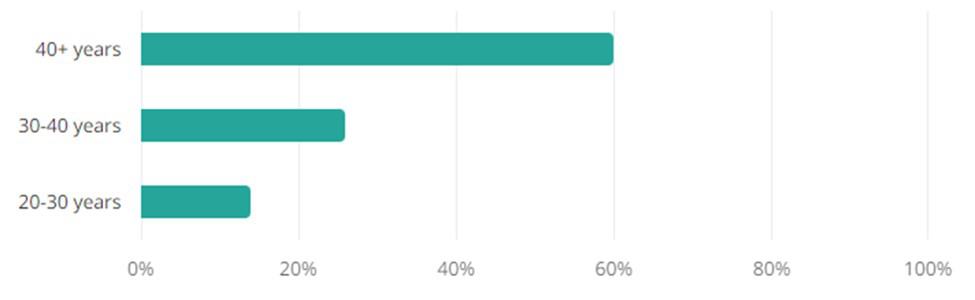

Age:

Regarding age demographics, the insurance sector tends to attract a blend of experience and youthful energy:

- Average age: 43.7 years

This average suggests a workforce rich in experience and knowledge, contributing depth to the industry’s expertise.

These demographics illustrate a field in transition, moving towards greater inclusivity and diversity. While strides have been made, continuous efforts are essential to ensure every talent feels welcomed and valued in the insurance industry.

Salary Trends

Understanding salary trends is crucial for anyone considering an insurance career. Whether you’re eyeing entry-level or specialized roles such as life insurance agent jobs and R.N. insurance jobs, it’s essential to have a pulse on the potential earnings.

- The average salary for U.S. insurance professionals is approximately $60,000 annually. However, this figure can vary widely depending on factors such as experience, location, and the specific area of expertise within the insurance sector.

- Entry-level positions may start lower, but the industry offers robust pathways for growth. Professionals with specialized certifications or in roles such as insurance investigators can expect higher earnings.

- There’s also a progressive push towards equitable pay within the sector. For instance, women in insurance jobs earn closer to their male counterparts than ever before, with the gap narrowing to a mere few cents on the dollar—a testament to the industry’s efforts to foster an inclusive and fair workplace.

What’s encouraging is the sector’s commitment to diversity and inclusion, translating into equitable compensation practices. For the latest wage insights and trends across various roles, including insurance investigator jobs, staying informed can help you navigate your career path effectively.

Hiring Trends

The landscape of hiring in the insurance sector reflects the challenges and opportunities presented by an ever-evolving market. Recognizing these trends can provide invaluable insight for job seekers.

- Geographical Hotspots: Certain locations, such as New York, NY, and Chicago, IL, remain key hubs for insurance professionals, buoyed by the concentration of financial and insurance institutions.

- Remote and Hybrid Work Dynamics: Insurance companies increasingly turn to remote and hybrid work models as the industry evolves and faces a wave of retirements. This shift offers new remote insurance job opportunities and emphasizes a commitment to flexibility and efficiency.

- Sector-Specific Growth: Areas such as cybersecurity insurance and climate change coverage are experiencing rapid growth, leading to a surge in demand for specialists in these fields.

- Technology’s Influence: Integrating technology into insurance processes generates demand for roles at the intersection of I.T. and insurance. Skills in data analytics, cybersecurity, and digital marketing are increasingly valuable.

- Diversity and Inclusion Efforts: Companies prioritize recruiting diverse employees, reflecting a broader industry push towards inclusivity. This includes strategies aimed at hiring more women, veterans, and underrepresented groups.

The insurance industry is poised for growth, driven by new risks and the digital transformation of traditional processes. Stay attuned to these trends for those looking to dive into insurance jobs, which can illuminate pathways to entry-level positions and advanced roles. The sector’s commitment to embracing various talents and backgrounds signals a promising future for prospective job seekers.

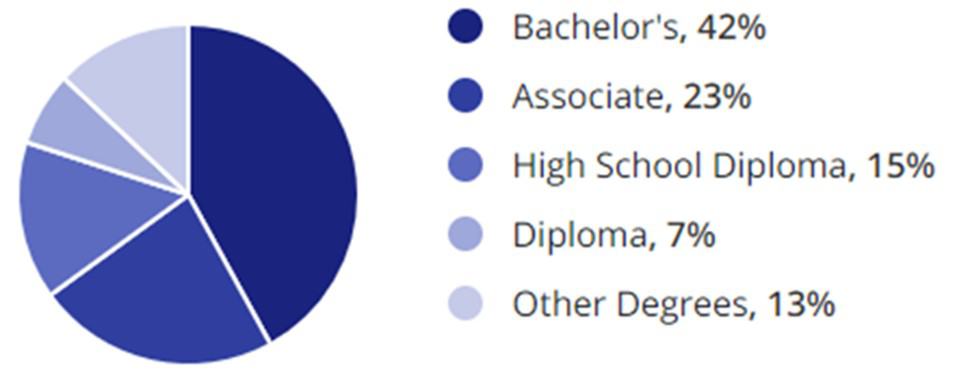

Education Levels

The insurance industry values education highly, understanding that well-informed professionals are crucial to navigating the complexities of insurance policies and regulations. Let’s explore the educational background that sets the stage for an insurance career:

- Bachelor’s Degrees: Most insurance professionals begin with a bachelor’s degree in business, finance, or economics. This foundation is crucial for understanding the basic principles that govern the industry.

- Certifications: Beyond degrees, certifications are critical in advancing within the sector. Designations like Chartered Property Casualty Underwriter (CPCU) and Certified Insurance Counselor (CIC) signal expertise and dedication to continuous learning.

- Advanced Degrees: While not always necessary, a master’s degree or higher can be a significant advantage, especially in analytical or management roles. Advanced education can deepen understanding and open doors to higher-level positions.

- Continuing Education: The insurance industry continuously evolves with new policies, technologies, and methodologies. Ongoing education through workshops, courses, and seminars is encouraged to keep pace with these changes.

The mix of formal education and continuous professional development underpins the dynamic and knowledgeable workforce within the insurance sector. Whether just starting with entry-level insurance jobs or aiming for specialized roles, the emphasis on education is a stepping stone to success. This approach fosters an environment where both the newcomer and the seasoned professional can thrive.

Skills in Demand

The insurance industry is not just about understanding policies and regulations. Success in this field also hinges on diverse hard and soft skills. As the industry adapts to new challenges and technologies, specific skills have come to the forefront:

- Customer Service: Exceptional communication and empathy are crucial for helping clients navigate their insurance needs and concerns.

- Attention to Detail: Precision is critical in reviewing policies, processing claims, and ensuring compliance with regulations.

- Analytical Thinking: Assessing risk and making data-driven decisions is invaluable, especially in underwriting and claims adjusting.

- Technological Proficiency: As the industry embraces digital transformation, skills in data analysis, cybersecurity, and digital marketing are increasingly important.

- Adaptability: The insurance landscape is ever-evolving, with new products, regulations, and risks. Professionals must be ready to learn and adjust to stay ahead.

These skills are essential across various roles, from entry-level positions to specialized insurance investigators and executive insurance jobs. Cultivating these capabilities will make you a competitive candidate and prepare you for a rewarding, long-term career in the insurance industry.

Current & Future Insurance Jobs Outlook

The outlook for insurance jobs is both promising and dynamic. As society grapples with unprecedented challenges like climate change and cyber threats, the role of insurance has never been more critical. Here’s what the future holds:

- Growth in Specialized Fields: There’s an increasing demand for specialists in emerging risks such as cyber insurance and climate change-related policies. Professionals with expertise in these areas can expect significant opportunities.

- Digital Transformation: The insurance industry is embracing technology, leading to a surge in demand for those skilled in digital tools, data analysis, and online marketing. This technological shift is creating new roles and transforming traditional ones.

- Emphasis on Inclusivity: Efforts to create a diverse and inclusive workforce are intensifying. Companies seek professionals from varied backgrounds and experiences to serve diverse clientele better and foster innovative solutions.

- Evolving Customer Expectations: As consumers demand more personalized and efficient services, insurance professionals adept at customer engagement and digital communication will be highly sought after.

The sector offers stability and growth, making insurance jobs appealing to many. Whether you’re interested in traditional roles, emerging specialties, or remote insurance jobs, the insurance industry is ripe with potential for fulfilling careers that make a difference.

FAQ’s

What Education is Required for Insurance Jobs?

Most insurance roles require a bachelor’s degree in business, finance, or related. Specialized certifications and continuous professional development are also crucial for advancement.

Are There Entry-Level Opportunities in Insurance?

Yes, the industry offers a range of entry-level insurance jobs that serve as a stepping stone to more specialized roles. These positions are great for gaining experience and understanding the basics of the field.

Can I Work in Insurance Without a Degree?

While most positions require a degree, certain sales or support roles may offer pathways without a formal degree, especially if you have relevant certifications or experience.

Is Experience in Finance Necessary?

Not necessarily. While a background in finance can be beneficial, insurance also values skills in customer service, technology, and analysis. Diverse experiences can contribute to a successful career in insurance.

How Important Are Certifications?

Certifications can significantly impact your career, demonstrating your professional expertise and commitment. They are essential for advancement and specialization in the industry.

What Skills Are in Demand in the Insurance Sector?

Skills like customer service, attention to detail, analytical thinking, and technological proficiency are highly valued. The ability to adapt to new challenges and regulations is also crucial.

Additional Resources

To support your journey in the world of insurance, here are some additional resources:

- For industry insights and educational materials, visit the Insurance Information Institute. It’s a treasure trove of information about the insurance sector.

- To understand regulations and stay updated on policy changes, the National Association of Insurance Commissioners (NAIC) offers comprehensive resources and guidelines.

- If you want to expand your knowledge and skills in property and casualty insurance, the American Institute For Chartered Property Casualty Underwriters is an excellent place to start.

These resources can provide a foundation for understanding the insurance industry, exploring career paths, and finding educational opportunities to advance your career.

Conclusion

The insurance industry offers a dynamic and rewarding career path for those interested in making a difference in people’s lives and navigating the complexities of risk and protection. With a broad range of roles, from entry-level positions to specialized insurance investigator jobs, there is a place for diverse talents and interests. Education, continuous learning, and developing in-demand skills pave the way for success in this sector. The industry’s commitment to diversity and inclusion, alongside efforts to embrace technology and innovation, creates a fertile ground for career growth and fulfillment.

Embarking on this journey requires the right job search websites, resources and community. Join Diversity Employment today to connect with opportunities, learn from a network of professionals, and take your insurance career to the next level. Together, let’s shape a future where the insurance industry reflects the diversity and dynamism of the world it serves.