Welcome to your comprehensive guide on forging a successful path in finance jobs. Whether you’re stepping into this dynamic field for the first time or looking to elevate your career to new heights, this guide will equip you with essential insights and strategies for success. The finance sector is not just about managing money; it’s a crucial engine driving economic growth, innovation, and opportunity across industries and around the globe. The need for skilled, diverse, and adaptable professionals has never been greater.

In the following pages, you’ll discover the educational foundations that will set you up for success, dive into specific areas of expertise within the realm of finance, and learn about the demographics shaping the industry in the United States. We’ll also cover salary trends to help you navigate your earning potential, hiring trends that illuminate the most sought-after roles and skills, and the current and future outlook for finance careers, giving you a clear vision of the road ahead.

As the finance industry evolves with technological advancements and a growing emphasis on diversity and inclusion, ambitious individuals have ample opportunities to make their mark. Our guide aims to be your beacon, guiding you through the intricate pathways of the finance sector, helping you identify where your passion and skills can best be applied, and showing you how to build a rewarding and meaningful career.

So, let’s embark on this journey together, embracing the challenges and opportunities that lie ahead, and take a step closer to realizing your dream finance job. Welcome to the world of finance — your adventure starts here.

Educational Requirements

Launching a career in finance requires a blend of academic achievement and real-world skills. Aspiring professionals at the foundation often start with a bachelor’s degree in finance, accounting, economics, or business administration. These programs equip students with the essential knowledge in mathematics, statistics, and financial principles critical for a wide range of finance Jobs.

For those aiming at higher echelons in their finance career, such as automotive finance manager jobs, finance director jobs, or finance manager jobs, further education is often pursued. A Master of Business Administration (MBA) is a popular choice for advancing in the field. Additionally, gaining specialized certifications can make a significant difference. The Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) designations are markers of expertise and commitment to the profession.

These certifications validate one’s knowledge and skills and signal a high degree of professionalism to potential employers. They require dedication and rigorous study, often involving several levels of examinations. However, the rewards are substantial in terms of job opportunities and salary prospects. Gearing up with these qualifications opens doors to higher positions and specialized areas within the finance industry, making candidates more competitive in the job market.

This foundation of education and certification ensures that professionals enter the finance field with a solid knowledge base and continue to grow and adapt in a constantly evolving sector. Being well-prepared academically is the first step to a successful career in this dynamic and critical industry.

Areas of Expertise

The finance sector is broad and offers a variety of paths for professionals to specialize in. Choosing an area of expertise depends on personal interests, skills, and career goals. Below are some of the critical specializations within finance:

Corporate Finance

Specialists in corporate finance jobs manage the financial activities within a company. They work on tasks such as determining capital structure, managing budgets, and making strategic investment decisions. Their primary goal is to maximize shareholder value through long and short-term financial planning.

Investment Banking

Investment bankers specialize in helping organizations raise capital. They offer advisory services on mergers, acquisitions, and other types of financial transactions. This role is critical for companies looking to expand or restructure. It’s often regarded as highly prestigious within finance jobs.

Asset Management

Asset managers play a critical role in handling clients’ investment portfolios. They make decisions on purchasing or selling assets to achieve investment goals. This specialization requires an in-depth understanding of market trends and financial instruments.

Risk Management

Risk managers identify and assess potential risks affecting a company’s financial health. They develop strategies to minimize or mitigate risks related to the financial industry. Their work is crucial for maintaining the stability and security of economic systems.

Financial Planning

Financial planners offer advice to individuals and businesses on how to achieve their long-term financial objectives. They help clients create a roadmap to economic security, including saving for retirement, education, and other financial goals.

Each of these areas requires a unique set of skills and knowledge. Finance professionals may specialize deeply in one area or develop a broader skill set to open up career opportunities across several areas. Regardless of the chosen specialization, building expertise in a particular field can enhance a professional’s value in the marketplace and create a path to rewarding finance jobs.

Demographics in the United States

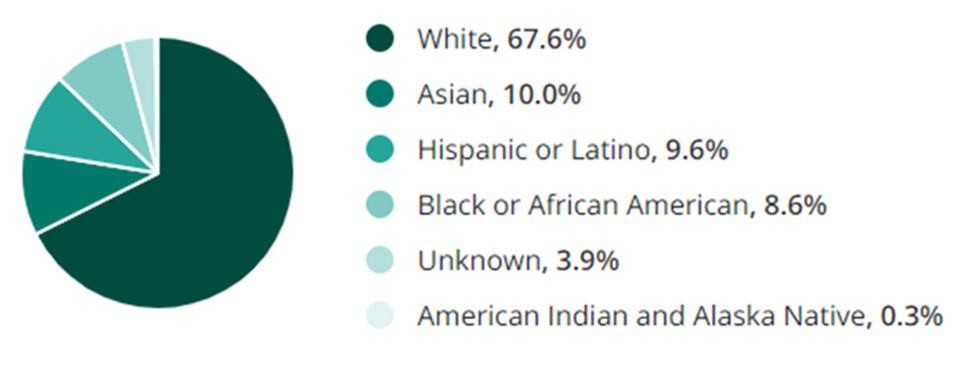

Ethnicity/Race:

The diversity within finance jobs in the U.S. reflects a variety of ethnic and racial backgrounds. Here’s a quick snapshot:

- White: 67.6%

- Asian: 10%

- Hispanic or Latino: 9.6%

- Black or African American: 8.6%

- Unknown: 3.9%

- Native American and Alaska Native: 0.3%

This mix signifies the finance sector’s evolving nature, striving for increased representation from various ethnic groups. A diverse finance workforce offers varying perspectives crucial for innovative financial decision-making.

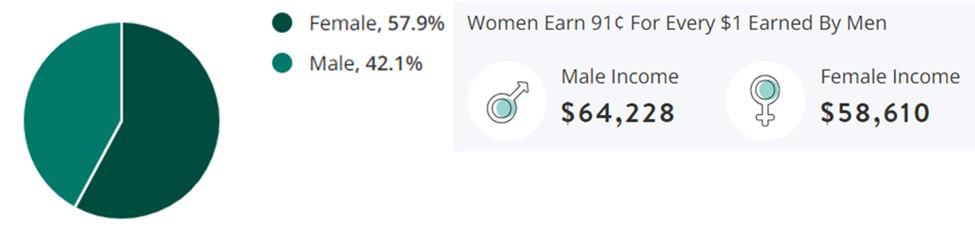

Gender:

The gender composition within the finance industry is also shifting towards more equality:

- Female: 57.9%

- Male: 42.1%

Although progress towards gender parity is ongoing, the finance industry actively promotes gender diversity, especially in leadership roles.

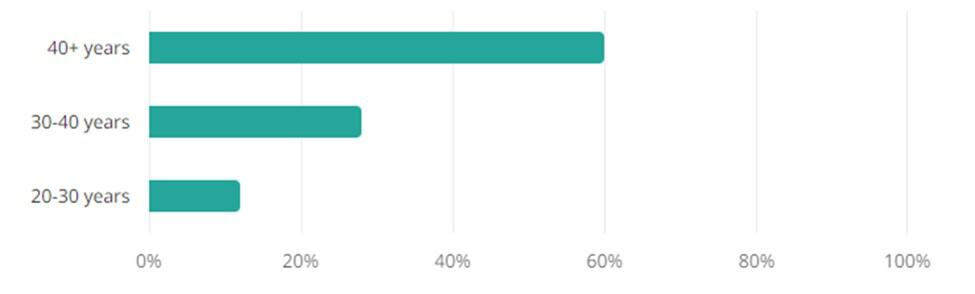

Age:

Finance jobs attract a wide age range of professionals, with the average age being over 40. This diversity in age brings together:

- Youthful innovators with fresh financial strategies

- Seasoned experts with deep market knowledge

Young professionals often introduce modern tools and approaches, while experienced ones offer invaluable insights into risk management and market dynamics.

The finance sector’s demographics mirror the importance of diversity and inclusivity in fostering a resilient and innovative workforce. By embracing diversity in ethnicity, gender, and age, the finance industry is better equipped to address the needs of a global client base and navigate the complexities of modern financial landscapes.

Salary Trends

Salaries in the finance sector can vary significantly based on role, experience, location, and specialization. On average, finance professionals in the U.S. may find their salaries range from entry-level positions to the top echelons of the industry.

- Entry-level positions: Starting salaries are around $55,000, offering newcomers a solid incentive to enter finance.

- Mid-career roles: Professionals with some years of experience, such as financial analysts or accountants, can expect salaries from $70,000 to $120,000.

- Senior roles: High-level positions in investment banking such as Finance Directors or Chief Financial Officers typically offer salaries starting from $150,000 and can exceed $250,000, particularly with bonuses and profit-sharing.

Specializations also influence salary outcomes. For example, automotive finance manager jobs and finance director jobs often command higher salaries due to their crucial role in the financial success of organizations. Similarly, finance manager jobs in competitive sectors or regions may offer premium compensation packages.

Despite these general trends, it’s essential to note that numerous factors influence salaries, including educational background, certifications, and the specific demands of each position. Moreover, the ongoing evolution in the financial industry, with increased digitalization and new financial products, may lead to shifts in compensation structures and new opportunities for career advancement.

Staying informed about the latest salary trends and understanding how various factors impact compensation can help finance professionals make strategic career decisions and negotiate effectively for their worth.

Hiring Trends

The finance industry is experiencing significant shifts in hiring trends due to technological advancements, regulatory changes, and evolving market needs. Here’s a glance at some of the current and emerging trends influencing finance recruitment:

Increased Demand for Technological Proficiency

Finance jobs now more than ever require candidates with strong digital skills. Proficiency in financial software data analytics and familiarity with blockchain and fintech innovations are increasingly sought after. Candidates who can bridge the gap between traditional finance roles and technology are in high demand.

Focus on Compliance and Risk Management

In light of global financial regulations becoming more stringent, there’s a growing need for professionals skilled in compliance and risk management. Companies seek individuals who can navigate the complex regulatory landscape to avoid hefty fines and maintain reputational integrity.

Growth in Sustainable Finance

As more investors and companies prioritize environmental, social, and governance (ESG) criteria, there’s a sharp rise in jobs focusing on sustainable finance. This trend reflects a broader shift towards responsible investment practices and financial products that support environmental and social goals.

Remote and Flexible Work Arrangements

The COVID-19 pandemic has accelerated the adoption of remote work in the finance sector. Employers are increasingly offering flexible work arrangements to attract and retain talent. This change is expected to persist, with hybrid work models becoming a staple in the industry.

The landscape of finance jobs is evolving, with traditional roles being reshaped by technology and new areas of expertise emerging. For finance professionals, staying abreast of these trends is critical to navigating the job market successfully and securing opportunities that align with the industry’s future direction.

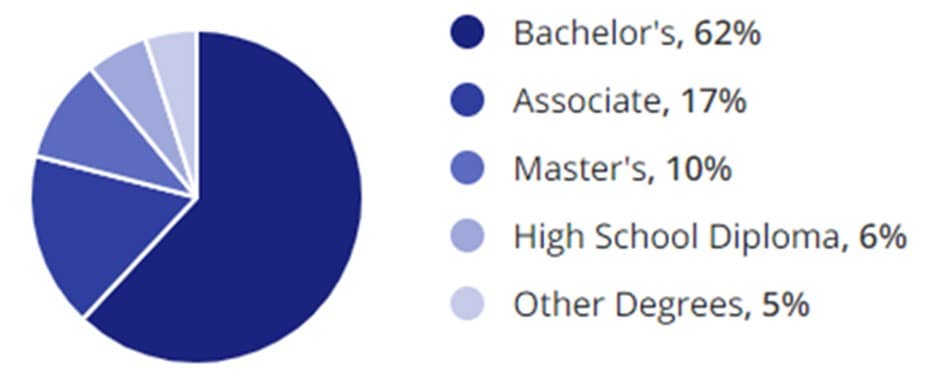

Education Levels

In the finance industry, the level of education achieved by professionals often correlates with career progression and opportunities. Here’s a breakdown of education levels within the sector:

Bachelor’s Degree

Most finance roles require at least a bachelor’s degree in finance, economics, accounting, or business administration. This foundational education equips individuals with the essential knowledge for entry-level finance jobs.

Master’s Degree

An increasing number of finance professionals are pursuing master’s degrees, such as an MBA or a Master’s in Finance, to deepen their knowledge and enhance their marketability. These advanced degrees are particularly valued in competitive areas like investment banking and corporate finance.

Certifications

Certifications like the Chartered Financial Analyst (CFA) and Certified Financial Planner (CFP) are highly respected in the finance industry. These certifications require passing rigorous exams and often years of relevant work experience, but they can significantly boost a professional’s credentials and career prospects.

Continuing Education

Given the fast-paced evolution of the finance sector, professionals must engage in continuous learning. Keeping up with the latest financial regulations, technologies, and market trends is crucial for career advancement and effectiveness in their roles.

Aspiring finance professionals should aim for academic credentials, certifications, and ongoing education to stay competitive in the job market. The blend of formal education and practical experience is critical to building a successful career in finance.

Skills in Demand

The finance industry is not just about numbers; it’s about making sound decisions, understanding complex systems, and communicating effectively. Here’s a rundown of the skills that are currently in high demand across various finance jobs:

Technical Expertise

- Financial Modeling: Proficiency in building models that represent financial scenarios is crucial for analysis and decision-making.

- Data Analysis: The capacity to interpret and derive meaningful insights from vast datasets is invaluable.

- Accounting Skills: A solid understanding of accounting principles is fundamental for corporate finance and asset management roles.

Technological Proficiency

- Software Knowledge: Familiarity with financial software platforms, like QuickBooks for accounting or Bloomberg Terminal for market analysis, is essential.

- Fintech Innovation: Staying up-to-date with the latest fintech developments can distinguish candidates in a competitive job market.

Soft Skills

- Communication: Clear and effective communication is necessary for presenting financial data and collaborating with teams.

- Problem-solving: Identifying issues and thinking through solutions is critical, especially in risk management and financial planning roles.

- Adaptability: With the fast pace of change in financial markets and regulations, professionals must adapt quickly.

In addition, ethical judgment and regulatory knowledge are becoming increasingly important, especially in light of financial scandals and tighter regulations. Developing a diverse set of technical and soft skills skills is critical to a successful career in finance. Keeping skills sharp and current ensures professionals remain relevant and highly sought after in the job market.

Current & Future Finance Jobs Outlook

The finance industry is pivotal, with technology, regulation, and global economic factors shaping its future. The outlook for finance jobs is promising, reflecting these dynamic changes. Here’s what professionals can expect in both the current landscape and the years ahead:

Continued Growth

- The finance sector is expected to grow, driven by economic expansion and the need for financial expertise across industries.

- Demand for risk management, compliance, and fintech roles is particularly pronounced, reflecting the industry’s evolving challenges and opportunities.

Technological Transformation

- Technology will continue to redefine finance jobs. Professionals with digital banking, blockchain, and artificial intelligence skills will find numerous opportunities.

- The rise of fintech startups is also creating new job roles, blending traditional finance knowledge with cutting-edge technology.

Sustainable and Ethical Finance

- As investors and consumers become more conscious of environmental and social issues, sustainable finance will grow significantly. Professionals knowledgeable in ESG (Environmental, Social, and Governance) criteria will be in demand.

- Ethical considerations and transparency in financial dealings are becoming more critical, opening up roles for professionals who can ensure compliance and foster trust.

Global Opportunities

- With the global economy becoming more interconnected, professionals understanding international finance, regulatory environments, and cultural competencies will find their skills highly valued.

The landscape of finance jobs is evolving, with a clear shift towards technology, sustainability, and ethical finance. Staying ahead in this dynamic industry requires professionals to adapt, learn, and acquire new skills continuously. Those who do will find themselves well-positioned to capitalize on the vast array of opportunities presented by the future of finance.

FAQ’s

What educational background do I need for a career in finance?

Most finance jobs require at least a bachelor’s degree in finance, economics, accounting, or business administration. Advancing further often involves pursuing higher education like an MBA or relevant certifications such as CFA or CFP.

Is it essential to specialize in a particular area of finance?

While a broad understanding of finance is beneficial, specializing in corporate finance, investment banking, or risk management can enhance your job prospects and potential for career advancement.

What skills are most in demand for finance jobs?

Apart from technical prowess in financial modeling and data analysis, employers look for professionals with strong soft skills, such as communication, problem-solving, and adaptability. Technological proficiency, especially in fintech innovations, is also highly valued.

How is technology impacting finance careers?

Technology is reshaping finance, creating a demand for professionals skilled in digital banking, data analytics, and blockchain. Finance jobs now require a blend of traditional financial knowledge and tech savviness to navigate the evolving landscape.

Are finance jobs well-paid?

Finance is known for its competitive salaries, with compensation varying by experience, specialization, and location. Roles in investment banking, for example, are among the highest paying in the industry.

Is the finance industry growing?

The finance industry is expected to grow, driven by expanding economic activity, technological advancements, and the increasing complexity of financial services and products.

How can I remain competitive in the finance job market?

To stay competitive, finance professionals should focus on continuous learning and development, keeping abreast of industry trends, enhancing tech proficiency, and obtaining relevant certifications.

These FAQs provide a quick look at some of the critical considerations for anyone looking to build or advance their career in finance. Staying informed and proactive about professional development is crucial in this dynamic field.

Additional Resources

In pursuit of a career in finance, having access to the right resources can make a significant difference. Here are some valuable platforms where you can find further information, tools, and support to enhance your finance career journey:

Educational Institutions

- Many universities offer free or low-cost online courses in finance and related fields. Renowned institutions like Harvard and MIT provide access to lectures and materials through online learning platforms.

Professional Associations

- The CFA Institute is a global association of investment professionals offering the CFA designation, one of the world’s most respected and recognized investment credentials.

- The Certified Financial Planner Board sets and enforces standards for CFP certification, which is essential for those looking to excel in financial planning.

Regulatory Bodies

- Understanding the regulatory environment is crucial in finance. The U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) provide resources on regulatory frameworks and compliance requirements.

Industry Research

- For the latest industry insights and research, the Federal Reserve offers extensive reports and data on economic and financial conditions, invaluable for finance professionals.

These resources provide information and can be excellent tools for aspiring and current finance professionals. Whether advancing your education, staying informed about the regulatory landscape, or connecting with industry peers, leveraging these resources can significantly contribute to your career success.

Conclusion

Embarking on a career in finance is a journey of continuous learning and adaptation, offering opportunities to play a pivotal role in economic growth and development. With the proper education, specialization, and blend of skills, professionals can navigate the dynamic landscape of finance to find rewarding and impactful careers. The finance sector’s growth and increasing embrace of diversity and technology create a fertile ground for ambitious individuals.

To maximize your career potential in this vibrant field, staying informed about diversity job boards, industry trends, regulatory changes, and technological advancements is crucial. Additionally, engaging with a community of like-minded professionals can provide the support, resources, and opportunities needed for success.

We invite you to join Diversity Employment. By becoming part of our community, you’ll gain access to a wide range of job opportunities, resources, and insights tailored to promoting diversity and inclusion in the workplace. Together, we can help you build a fulfilling career that meets your professional goals and contributes to a more diverse, equitable, and innovative finance industry.