Welcome to the ultimate guide for anyone interested in exploring or advancing their career in banking. This sector, a cornerstone of the global economy, offers a breadth of opportunities for individuals eager to make an impact within the financial landscape. Banking jobs are not just about transactions and accounts; they’re at the heart of economic growth, innovation, and customer service. Whether you’re drawn to the dynamic world of investment banking, the tech-driven realm of fintech, or the customer-focused atmosphere of retail banking, this guide is designed to help you navigate your career path.

Banking is a field that values precision, analysis, and interpersonal communication, making it a welcoming environment for a diverse range of talents and backgrounds. Moreover, with the industry’s emphasis on digital transformation and inclusion, there’s never been a better time to consider a career in banking. From understanding the educational requirements to identifying the skills in demand, this guide provides essential information and resources to take your first step or next leap in your banking career.

Join us as we explore the various facets of banking jobs, including potential career paths, the importance of diversity in the sector, salary trends, and the future outlook of banking employment. This comprehensive overview gives you the knowledge and insights to pursue your banking dream job confidently.

Educational Requirements

Starting a career in banking jobs often begins with a solid educational foundation. Most roles within the banking sector, such as entry-level and work-from-home banking positions, require at least a bachelor’s degree. The fields of finance, business administration, or economics are the typical pathways for those interested in entering the banking industry. These disciplines provide the essential knowledge and skills to understand and manage financial transactions, customer relations, and market trends.

Further education becomes crucial for those aspiring to advanced roles, such as in investment banking or financial analysis. A master’s degree, particularly an MBA (Master of Business Administration), or specialized certifications like the Chartered Financial Analyst (CFA) can significantly enhance one’s qualifications. These advanced qualifications expand one’s knowledge and substantially improve job prospects in competitive areas like banking fintech jobs and higher positions at institutions like Chase Bank.

Moreover, with the rise of digital banking and fintech, additional courses in digital finance, cybersecurity, and data analysis can be beneficial. This knowledge is increasingly relevant as the number of work-from-home banking jobs and tech-centric roles within the sector grows. Keeping current with these skills can position candidates favorably for the evolving demands of the banking profession.

Areas of Expertise

The banking sector encompasses a diverse array of roles that cater to different skills and interests. From front-office customer interactions to behind-the-scenes analytics, the opportunities are vast for those seeking banking jobs. Understanding these areas of expertise can help job seekers align their career paths with their strengths and passions.

Retail Banking

Retail banking is at the frontline, dealing directly with individual customers and small businesses. This area includes roles like bank tellers, personal bankers, loan officers, and customer service representatives. It’s ideal for those who excel in customer interaction and are looking to start in entry-level banking jobs.

Commercial Banking

Commercial banking provides services to mid-market businesses, including loans, treasury services, and credit products. Careers in this domain require strong analytical skills and the ability to build long-term client relationships.

Investment Banking

Investment banking is known for its high stakes and lucrative rewards, offering advisory services and funding to corporations and governments. It’s suited for those with a strong quantitative background, exceptional analytical capabilities, and a keen interest in financial markets.

Private Banking and Wealth Management

This area specializes in managing assets for high-net-worth individuals, offering personalized financial planning and investment advice. It’s perfect for those who combine financial acumen with outstanding personalized service.

Corporate Banking

Corporate banking delivers tailored financial solutions for large organizations, such as managing cash, financing operations, or facilitating mergers and acquisitions. It demands an in-depth understanding of complex financial instruments and the corporate landscape.

FinTech and Digital Banking

The rise of technology in finance has spawned a new era of banking fintech jobs. These roles blend traditional banking with technological innovations, involving everything from blockchain to digital payment systems. It is ideal for tech-savvy individuals looking to impact how banking services are delivered.

Choosing the right area of expertise in banking can lead to a fulfilling career. Matching one’s skills and interests with the right banking domain is essential. Whether your passion lies in direct customer interaction, financial analysis, or technological innovations, you have a place in the banking sector.

Demographics in the United States

The banking sector in the United States exhibits a range of demographics, reflecting the nation’s diversity. This diversity is crucial for fostering an inclusive environment that resonates with a broad customer base. Understanding the ethnicity/race, gender, and age distribution within banking provides insights into the industry’s progress toward diversity and inclusion.

Ethnicity/Race:

The banking industry is becoming increasingly diverse, though challenges remain. In recent years, there has been a push towards more inclusive hiring practices, aiming better to reflect the ethnic and racial makeup of the country. Efforts by institutions to recruit from a broader range of backgrounds have led to a slow but steady increase in representation. This diversity is vital for bringing varied perspectives to financial services enhancing innovation and understanding across different communities.

Gender:

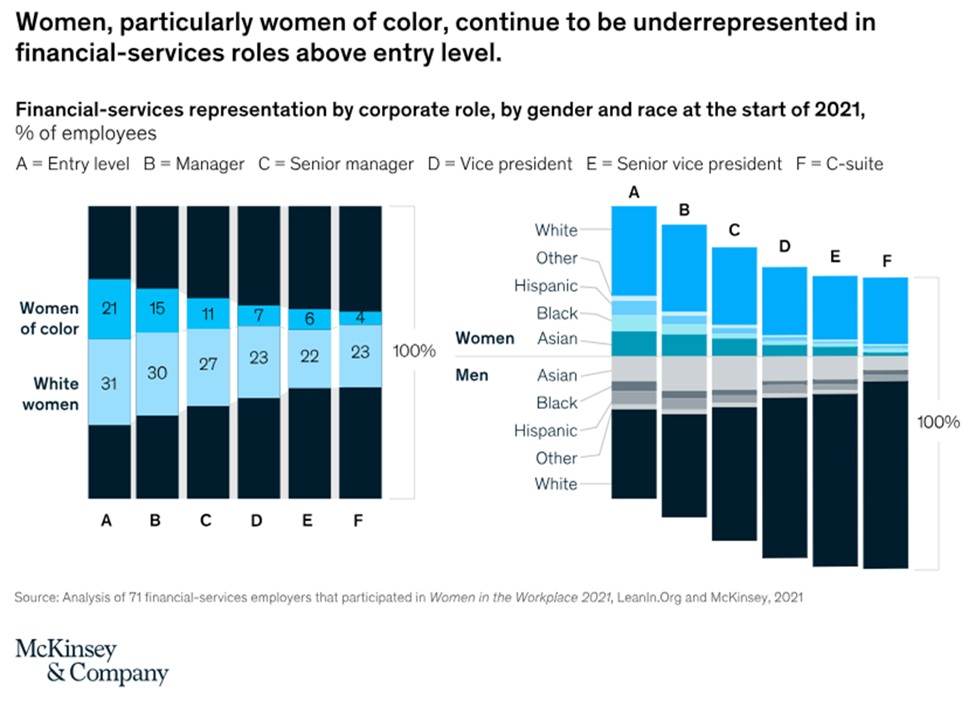

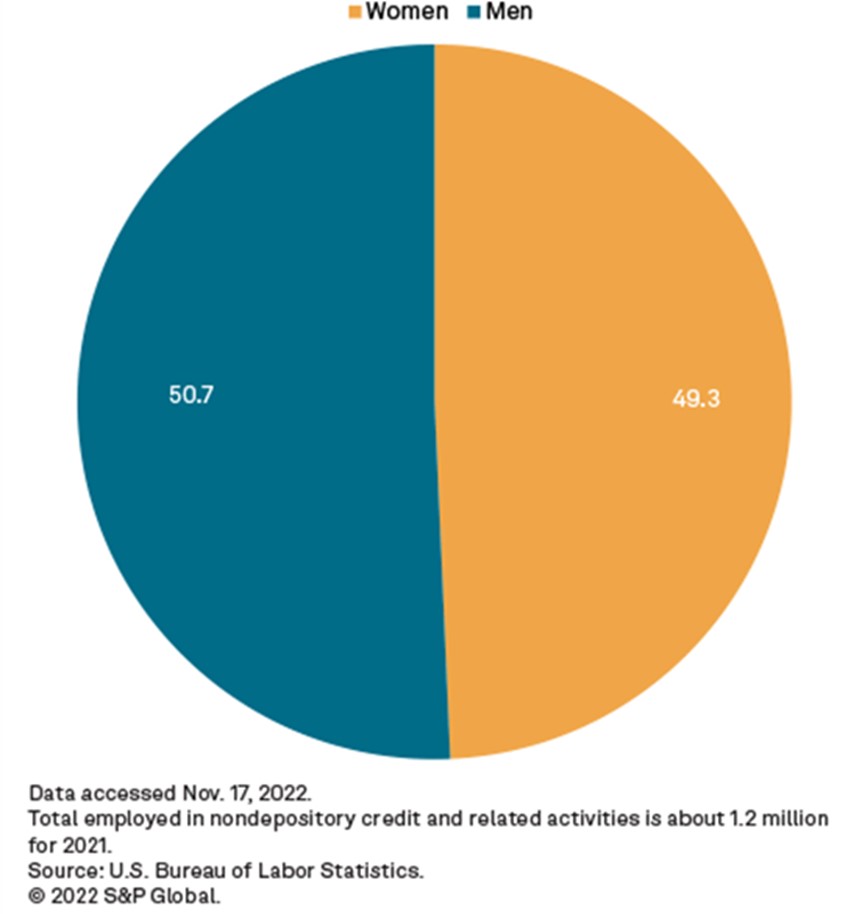

Gender distribution in banking jobs shows a balanced picture at entry and mid-management levels, with a diverse mix of genders contributing to the industry. Despite this balance, a noticeable gap exists in senior leadership roles, where male representation significantly outweighs that of females. Recognizing this, many organizations are actively working to implement programs that encourage and support women in obtaining leadership positions, aiming for gender parity at all levels of the organization.

Age:

The age demographics in banking are wide-ranging, welcoming young professionals entering the industry through programs and internships and experienced professionals occupying senior roles. The industry offers robust opportunities for career progression, making it an attractive option for individuals at different stages of their professional journey. Emphasis on multigenerational workforce dynamics ensures that diverse age groups contribute to and benefit from the evolving landscape of banking jobs.

The banking sector’s demographics in the US are a testament to the industry’s efforts towards creating a more diverse and inclusive workplace. As banks continue to evolve, the focus on widening representation across ethnicity/race, gender, and age is crucial for building an environment where varied perspectives drive innovation and growth.

Salary Trends

Salary trends in the banking sector offer a broad spectrum, influenced by position, location, and experience level. From entry-level banking jobs to high-tier executive positions, compensation varies significantly. However, the industry is known for its competitive salaries and attractive bonus structures, particularly in investment and corporate banking areas.

Overall Trends

On average, banking salaries have been on an upward trajectory, reflecting the industry’s resilience and growth. Entry-level positions offer a gateway to stable income, with opportunities for progression leading to substantial increases in earnings. Economic outlooks remain positive, with expectations of continued salary growth across the sector.

Role-Specific Insights

- Retail Banking: Jobs in retail banking, such as bank tellers and customer service representatives, often start with modest salaries. However, these roles frequently include benefits and potential for bonuses, contributing to overall compensation.

- Corporate and Commercial Banking: Corporate and commercial bankers enjoy higher salary ranges thanks to the specialized nature of their work and the significant financial transactions they handle. Bonuses and profit-sharing can substantially augment annual earnings.

- Investment Banking: Investment bankers stand out for their high earning potential, with base salaries far exceeding the average. When combined with performance-based bonuses, total compensation can reach remarkable levels.

- Technology and Fintech: With the growing integration of technology in banking, banking fintech jobs offer competitive salaries comparable to tech industry standards. The demand for these roles contributes to their robust compensation packages.

Geographic Variations

Location plays a crucial role in determining salaries within the banking industry. Major financial hubs, such as New York City, offer higher average salaries to compensate for the higher cost of living. Conversely, smaller markets may offer lower salaries but can benefit from a lower cost of living and potentially more significant work-life balance.

Understanding salary trends is vital for anyone considering a career in banking. While compensation can vary widely depending on several factors, the banking sector remains attractive for professionals seeking lucrative and rewarding careers.

Hiring Trends

The banking sector is experiencing a dynamic shift in hiring trends driven by technological advancements, evolving consumer expectations, and regulatory changes. These shifts influence the types of roles offered, the skills required, and the way banks engage with potential employees.

Technological Impact

As digital banking and fintech continue to advance, there is a notable increase in demand for professionals with technical expertise. This includes roles in data analytics, cybersecurity, and digital product development. The rise of AI and diversity initiatives in banking also calls for talent that can bridge the gap between traditional banking services and innovative tech solutions.

Diversity and Inclusion

Banks are placing a stronger emphasis on creating diverse and inclusive workplaces. This move is about fulfilling corporate social responsibility goals and recognizing the value diverse perspectives bring to financial services. Consequently, there’s an increase in outreach and recruitment strategies targeting underrepresented groups, aiming to enhance diversity across all employment levels.

Remote and Flexible Work Options

The COVID-19 pandemic accelerated a shift towards remote work, which has persisted. Banks are now offering more work-from-home banking jobs, recognizing the need for flexibility in attracting and retaining top talent. This flexibility particularly appeals to candidates seeking a better work-life balance and those residing outside major financial centers.

Skills and Qualifications

- Technical skills, especially in digital tools and platforms, are increasingly valued, reflecting the sector’s digital transformation.

- Soft skills like adaptability, leadership, and communication are becoming critical as banking jobs evolve to include more client-facing and team-oriented roles.

- Regulatory knowledge has become more important due to the complex compliance landscape in banking, emphasizing the need for candidates who are up-to-date with current laws and regulations.

The current hiring trends in banking reflect a sector amid transformation, ready to welcome professionals who can navigate the changing landscape. For those entering the banking industry, staying informed of these trends and adapting accordingly will be vital to finding and securing rewarding job opportunities.

Education Levels

The banking sector values education highly, with varying levels of academic achievement required depending on the role. Understanding the educational foundation necessary for different positions can help prospective employees navigate their career paths effectively.

Bachelor’s Degree

The most common entry point into banking jobs is obtaining a bachelor’s degree. Degrees in finance, economics, business administration, or related fields are typically preferred. These programs offer the essential knowledge in financial principles, market analysis, and business strategies needed for a successful start in the banking industry.

Advanced Degrees and MBA

For those aiming for specialized or higher-ranking positions, such as roles in investment banking or senior management, a master’s degree or an MBA can be crucial. These advanced degrees provide in-depth expertise in financial analysis, management strategies, and global market dynamics. They also offer networking opportunities, which is pivotal in the banking sector.

Professional Certifications

- Chartered Financial Analyst (CFA): Highly regarded in the banking sector, the CFA certification denotes investment management and financial analysis expertise.

- Certified Public Accountant (CPA): While more common in accounting, the CPA certification can also be valuable in various banking roles, showcasing a comprehensive understanding of financial regulations and reporting.

- Certified Financial Planner (CFP): For wealth management and financial planning roles, the CFP certification marks proficiency in personal financial planning.

Continuing Education and Skill Development

Given the fast pace of technological advancements and regulatory changes, continuous learning is crucial. Many banking professionals pursue additional courses, workshops, and seminars in emerging areas like fintech, cybersecurity, and compliance to stay competitive and relevant in the industry.

The banking sector offers various career opportunities for individuals with diverse educational backgrounds. Whether starting with a bachelor’s degree or advancing through additional certifications and degrees, the key to success lies in matching one’s academic achievements with the goals and demands of the desired role.

Skills in Demand

Specific skills are precious to employers in the rapidly evolving banking sector. These skills enhance an individual’s ability to perform their job effectively and position them as competitive candidates for career advancement. The demand spans both hard skills, which are specific, teachable abilities, and soft skills, which include personal attributes and interpersonal skills.

Hard Skills

- Data Analysis: The ability to understand and interpret data is crucial, especially for roles in risk management, market research, and financial analysis.

- Financial Reporting: Knowledge of financial reporting standards and practices enables professionals to create accurate financial documents critical for decision-making processes.

- Regulatory Compliance: As regulations evolve, expertise in local and international financial regulations ensures that banking operations remain compliant, reducing risk for the institution.

- Technological Proficiency: Familiarity with banking software, digital platforms, and emerging technologies like blockchain and AI is becoming increasingly important as the banking industry embraces digital transformation.

Soft Skills

- Adaptability: The banking sector’s fast-paced environment demands the ability to adapt quickly to market conditions, regulations, and technological advancements.

- Communication: Effective communication skills are essential for clearly conveying information to clients, team members, and management, especially in complex financial matters.

- Problem Solving: Identifying and resolving issues efficiently is critical, whether dealing with customer inquiries or navigating financial challenges.

- Leadership: For those in or aspiring to management roles, leadership skills are vital for motivating teams, driving innovation, and achieving business objectives.

The banking industry’s competitive landscape requires professionals with the necessary technical knowledge, expertise, and soft skills to excel in a dynamic and customer-oriented environment. Cultivating these in-demand skills can significantly enhance career prospects and success in banking jobs.

Current & Future Banking Jobs Outlook

The outlook for banking jobs remains positive, underscored by technological advancements, evolving financial services, and a growing emphasis on diversity and inclusion. As the sector adapts to these changes, both current and prospects for banking professionals look promising, with new opportunities emerging in traditional and innovative areas of the industry.

Current Landscape

The demand for traditional banking roles, such as loan officers, tellers, and customer service representatives, continues to be strong, offering stable entry points into the industry. Additionally, there’s a noticeable rise in regulatory compliance and risk management positions, driven by the sector’s increasing focus on governance and security.

Technological Advancements

Digital banking and fintech innovations are reshaping the banking landscape, leading to a surge in demand for tech-savvy professionals. Roles in cybersecurity, data analysis, and digital product management are expanding rapidly as banks seek to enhance online services and secure customer data. This shift indicates a growing need for professionals who can blend financial knowledge with technological expertise.

Diversity and Inclusion

Banks are making concerted efforts to diversify their workforce, recognizing the value of varied perspectives in serving a diverse client base. This has led to more inclusive hiring practices, aiming to attract talent from underrepresented groups and create equitable opportunities for advancement within the sector.

Future Prospects

- Integrating AI and machine learning into banking operations is expected to open new paths for innovation, requiring professionals with a blend of finance and tech skills.

- As remote and flexible working arrangements become more common, there will likely be an increase in remote banking jobs, appealing to a broader range of job seekers.

- The focus on sustainability and ethical banking is anticipated to grow, creating demand for roles centered around environmental, social, and governance (ESG) practices within the banking industry.

Overall, the outlook for banking jobs remains robust, with career growth and advancement opportunities. Professionals willing to adapt to industry changes, embrace new technologies, and commit to lifelong learning can look forward to a rewarding future in banking.

FAQ’s

What educational background is needed for a career in banking?

Most banking jobs typically require a bachelor’s degree in finance, economics, business administration, or a related field. Advanced positions may require a master’s degree or professional certifications such as CFA or CPA.

Are there opportunities for career growth in the banking sector?

Yes, the banking sector offers significant opportunities for career advancement. From entry-level positions, individuals can progress to leadership and specialized roles through experience, additional education, and skill development.

Is it necessary to have a background in finance to work in banking?

While a finance background is beneficial, it’s not mandatory for all roles. The banking sector has diverse needs, including customer service, IT, compliance, and risk management, where skills from various backgrounds are valued.

How is technology impacting banking jobs?

Technology is reshaping the banking sector, leading to a higher demand for professionals with digital skills. Roles in cybersecurity, data analysis, and digital banking are growing, reflecting the shift towards online and mobile banking services.

Can I find work-from-home opportunities in banking?

Yes, work-from-home opportunities in banking have increased, especially in roles such as customer service, data analysis, and compliance. The shift towards digital services and the impact of the COVID-19 pandemic have accelerated remote work options in the sector.

What efforts are being made to increase diversity in the banking sector?

Banks are actively implementing diversity and inclusion initiatives to create a more equitable and representative workforce. These efforts include targeted recruitment, mentorship programs, and development opportunities for underrepresented groups.

Are there part-time positions available in banking?

Yes, part-time positions are available, especially in retail banking roles such as tellers and customer service representatives. These positions can offer flexibility for individuals seeking to balance work with other commitments.

These FAQs cover some of the most common questions about pursuing a career in banking, offering insights into education, career paths, the impact of technology, and efforts toward inclusivity in the sector.

Additional Resources

For those seeking to start or advance their career in banking, a wealth of resources is available to aid in your journey. These additional resources can provide valuable support if you’re looking for more detailed information on banking careers, educational opportunities, or networking platforms.

Educational Resources

- For insights into finance and economics education, visit the American Economic Association. It offers resources for students, including educational guides and career advice.

- The Certified Financial Planner Board of Standards, Inc. provides details on becoming a certified financial planner, particularly useful for those interested in personal banking and wealth management.

Professional Associations

- The American Bankers Association is a crucial resource for anyone in the banking industry, offering training, news, and networking opportunities.

- For those focusing on the risk management aspect of banking, the Global Association of Risk Professionals provides certifications and educational resources.

Government Resources

- The Bureau of Labor Statistics offers in-depth information on various banking roles, including job outlooks, salary information, and educational requirements.

- The Federal Deposit Insurance Corporation (FDIC) is a crucial resource for current financial regulations and compliance guides.

These resources are invaluable for anyone looking to deepen their understanding of the banking sector, improve their qualifications, or connect with like-minded professionals. Exploring these can help you navigate your banking career with a more informed and strategic approach.

Conclusion

The banking sector offers a dynamic and rewarding career path for individuals with various skills and interests. The possibilities are vast, from traditional roles in retail and commercial banking to emerging opportunities in fintech and digital banking. Success in this field requires a strong foundation in education, a commitment to continuous learning, and technical and soft skills development. As the industry evolves, embracing technology and prioritizing diversity and inclusion, professionals in banking have the chance to grow and make a significant impact.

Weather you’re just browsing job hunting websites or looking to further explore banking opportunities and become part of a community that values diversity and inclusivity, we encourage you to join Diversity Employment today! By becoming a member, you’ll gain access to a wide range of resources, job listings, and networking opportunities designed to support your career journey in banking. Together, we can drive positive change in the banking sector, creating a more inclusive and representative workforce for the future.